Risk-free renting. Finally.

Renting gets unpredictable. Protect your rental income with SingleKey’s risk mitigation solutions for homeowners, rental businesses, and tenants.

Trusted by 90,000+ homeowners

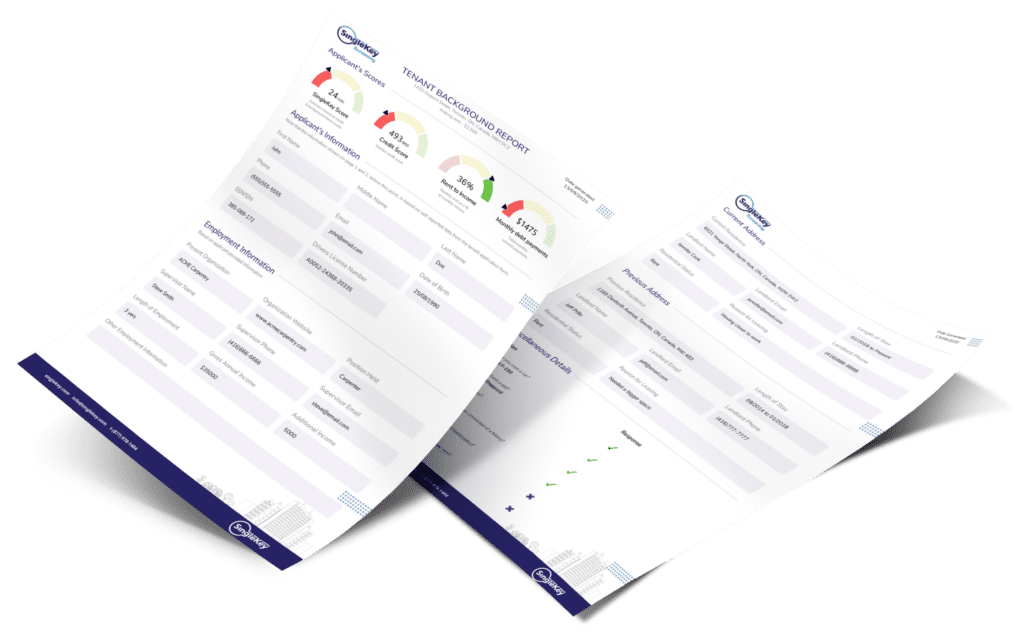

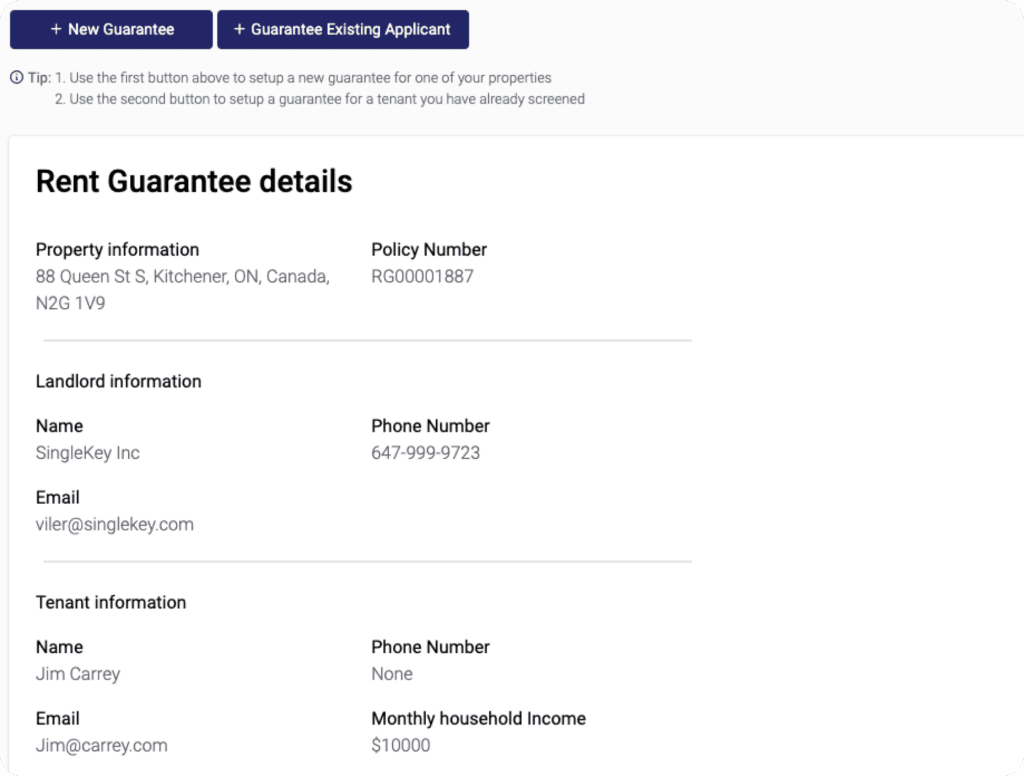

Meet SingleKey

Start-to-finish rental protection

Take the risk out of renting in 2 easy steps. Here’s how.

Renting, Reimagined

Relax, you’ve got SingleKey

No matter where you stand in the rental market, we’ve got a solution to take the stress out of renting.

Rent your place, risk-free

- Find tenants you can trust

- Help tenants build their credit score

- Get financial & legal backups the entire time

Learn more

Fill units faster & safer

- Speed through tenant screenings with the fastest report in the U.S.

- Free up time with seamless API integrations (No more forms to fill!)

- Enjoy exclusive partner perks & volume discounts

Keep your business thriving

- Find trustworthy tenants for your clients

- Protect clients with financial & legal backups

- Enjoy exclusive partner perks & volume discounts

You're in good company

Come join our fast-growing community. Today, we’re proudly serving:

90,000+

Homeowners

400,000+

Tenants

6,500+

Real estate agents

650+

Enterprise property managers

Powered by people & passion

SingleKey is changing the way renting is done. Learn how we’re fostering better homeowner-tenant relationships through thoughtful products built with purpose.

The Reviews Are In

“This company is a game-changer.”

“I used SingleKey for a background check and it has helped me find higher quality, more financially stable tenants. I have been using SingleKey's Rent Guarantee and automatic Rent Collection for almost a year now too. Peace of mind has a price. I haven't made a claim with them, my hope is that I never need to, but if I do, they will honor their Rent Guarantee program.”

J Wasney

SingleKey Rent Guarantee Customer

“This company is a game-changer. The screening service is fast and comprehensive. The website is well laid out and easy to use. Customer support is... actual customer support. People get back to you. Highly recommended.”

Taco van Ieperen

SingleKey Rent Guarantee Customer

“It is a pleasure to cooperate with you. Thank you for the kindness, professionalism and speed with which you work with clients. A wonderful team, and even more beautiful rental properties.”

Brankica Sarcevic

SingleKey Rent Guarantee Customer

“Very legit. Very professional. Very Canadian! I had a couple of issues at the beginning, but they were addressed quite quickly and properly. They are a good match to the business of landlording. Have recommended to others in the field."

a-a

SingleKey Customer

“As a landlord, SingleKey is a very important tool to have in your arsenal. The tenant screening tool was particularly useful when evaluating potential tenants as the program allows information to be pulled from various sources. The Rent Guarantee insurance was also very useful. I had a tenant stop paying his rent and SingleKey immediately refunded me my rent without question. I recommend any landlord big or small to give it a try.”

Alex

SingleKey Rent Guarantee Customer

“During my experience with the representative at Single Key, I was completely satisfied since everything was explained in detail to me, I fully understood and she answered all my questions. This representative went above and beyond in ensuring that I was quite happy with all resolutions. I'll certainly recommend SingleKey to friends and family. Thank you.”

Carlos B

SingleKey Rent Guarantee Customer

“Professional and easy to use service. Great support along the way.”

Timothy Ray

SingleKey Rent Guarantee Customer

- 4.8 stars from 500+ Google Reviews

Start risk-free renting today.

Rent safer and happier than ever with SingleKey.